Reviews Are the Brass Ring on Google's Carousel

/

Since early 2010, we have been advising our clients that improved online review scores drive demand for hotels, and that reviews can drive both visibility and demand within hotel review sites like TripAdvisor. Our own client-side research was bolstered by Chris Anderson's landmark research paper in November 2012, which demonstrated a direct relationship between review scores and the actual performance of hotels.

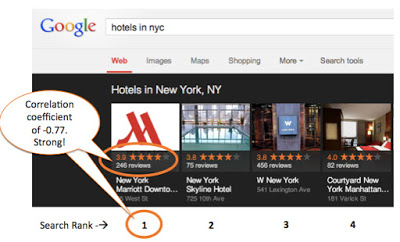

Until now, however, the industry has not been able to determine what effect, if any, review scores have on the visibility of hotels in Google's organic search results. With Google's release of Carousel in June, however, it seemed like a good time to try and tackle this question.

|

| What drives the placement of hotels from left to right in Google Carousel? |

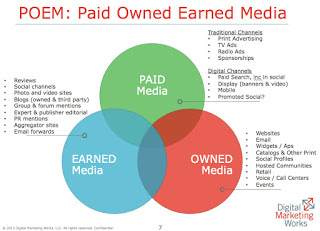

A deeper dive into Carousel also helps to round out DMW's recommendation for a Holistic Google Optimization Approach. For historical reasons, most brands (including hotel brands) have silos that manage Paid, Owned, and Earned media (POEM). Google increasingly considers all three of these areas as a whole, however, and brands must follow suit if they are to be successful. It is hard to overstate the importance of this; see our June blog post for more detail.

|

| Holistic Google Optimization requires a coordinated POEM approach across all Google assets. |

The Question: What level of influence, if any, do online reviews have upon a hotel’s Carousel ranking? To answer this question, we designed our study to focus on reviews and to set aside the many other complex factors that inform Google search results (like semantic, visual, personal, and price factors). While this creates a very simplified view of Search, it has enabled us to paint a clear picture and come to conclusions that we believe to be directionally correct and relevant.

Our summary finding: In a validation of predictions made in our initial Carousel blog post, the research showed a very strong correlation between Carousel rank and average review rating and quantity. Across all market tiers and search terms, the correlational coefficient of those data sets was -0.76 (out of a best-possible -1.0). Translation: Earned media (online guest reviews) is now a major component of Google's search results for hotels.

|

| DMW primary research shows a strong correlation of Google review data with Carousel rank |

DMW Primary Research: Details Snapshot

The findings and conclusions in this post are driven entirely from our own primary research. Here's a quick overview of the scope of the effort.

- DMW ran approximately 4,500 desktop Google searches for hotels in 47 markets in The United States.

- Each of these searches returned SERPs in the new Carousel format.

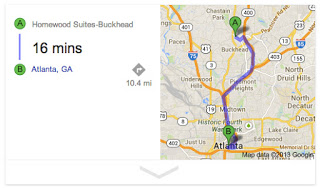

- For the top 10 hotels of each search, we collected the hotel’s name, rating, quantity of reviews, and rank (as displayed in Carousel). We also recorded the travel time and distance from each hotel to Google's definition of the given city.

- The markets themselves were selected from primary, secondary, and tertiary destination tiers. The majority (60%) of the markets in our study are primary markets.

- We used in equal measure the following popular hotel search terms:

- hotels in [city]

- best hotels in [city]

- downtown [city] hotels

- cheap hotels in [city]

- Our research yielded approximately 42,000 data points, including data on approximately 1,900 distinct hotels.

How We Used the Data

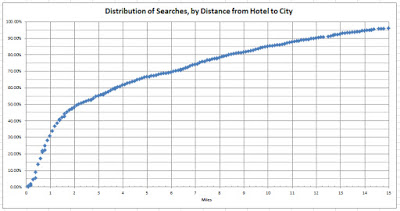

Our study looks for correlations between a hotel’s rank in a search result with each of the following: 1) Google review rating (out of five stars), 2) quantity of Google reviews, 3) travel time from the hotel to the searched city, and 4) driving distance from the hotel to the searched city. We can look for these correlations within all combinations of query type (like "best hotels in...") and market tier. For example, we were not surprised to see a strong correlation between rank and travel time/distance: closer hotels ranked higher.

|

| Time and distance from a specific hotel to Atlanta, as defined by Google |

Finding #1: Carousel rank correlates highly with Google review ratings. Our most important finding is encapsulated in the chart below. The relationship is impossible to miss. Our study also showed an equally strong correlation for a hotel's quantity of Google reviews. In both cases, these scores are on par with the correlation of time/distance and Carousel rank, suggesting that Google places a very high value on reviews indeed.

|

| Google Carousel search results correlate very strongly with the quantity of online reviews and average rating. |

- Recommendation: Improve your hotel’s visibility via a Review Optimization Program focused on more Google reviews. While most hotel brands remain focused on TripAdvisor, seize a new advantage by optimizing for Google reviews. In addition to improved visibility, online ratings also improve demand (via increased click through rates that lead back to brand-owned booking pages). The best way to measure your progress is with compset indices of review quality, quantity, and recency.

- Extra Note: In our research, 90% of all hotels had 150 or fewer Google reviews. If you're looking for an arbitrary measure of success, breaking through the 150 threshold would be a great start.

Finding #2: 50% of all 1,900 hotels in our study are within two miles of the searched destination. 75% are within 13 minutes of travel time. When we couple this discovery with the fact that Google is ranking hotels in increments of (at most) 0.1 miles, it suggests that a hotel that is literally down the block could conceivably get a small boost in Carousel ranking (because it is slightly closer to Google's abstract concept of that city).

- Recommendation: Promote what you're near. Attempt to educate guests into searching for specific landmarks and neighborhoods instead of the whole city. Hotels that are not lucky enough to be right next to Google's specific latitude / longitude for a city must educate their market. Attempt to influence guests to search for the specific landmarks and neighborhoods that you are close to. Use paid, owned, and earned media to get the message out.

Finding #3: Google is improving its ability to understand the nuance of our searches. Google appears to alter the weight of hotel factors depending on the nature of the search. Here is what the data revealed...

The correlation of review and distance data with rank varies by search term, suggesting that Google applies different weights to best respond to the nuances of our searches |

- The generic “hotels in [city]” query is relatively balanced between Reviews (at about -0.55) and time/distance (at about +0.62). Both of these scores are significant, but not exceptionally strong.

- When searching with the query “best hotels in [city]”, Google understands the user’s emphasis on quality and responds accordingly: it dials up review rating and quantity and dials down time/distance.

- If searching for “downtown [city] hotels”, however, Google determines that the user’s intent is more focused on location and provides different results. The correlation with time/distance goes up to a strong value and review data diminishes (but still remains significant).

- When searching for “cheap hotels in [city]”, we see no strong correlation with review data or time/distance. We assume this is because substantial weight is being given to what Google knows about the prices of hotels instead (not measured in this study).

- Recommendation: Pursue a coordinated Holistic Google Optimization effort across POEM because the sum is greater than the parts. Examples: We clearly see that SERPs for "best hotels in..." rely on reviews, but we know that good content factors in as well. The results of "Hotels in..." and "Hotels near..." searches are completely dependent on what the user has been educated to search for (landmarks instead of whole cities, we hope). "Cheap" searches will benefit from an optimized Google HPA program, of course, but should perform best with good review scores.

Finding #4: Our findings hold true across primary, secondary, and tertiary markets. While we see some variance per market tier, our overall findings hold true regardless of the size of the city.

- Recommendation: No hotel is too small to consider online reviews. Because we see a strong correlation of search rank and reviews for all three market tiers, even the smallest hotels should now consider a review optimization program. “We’re a small roadside motel” is no longer an excuse – especially in an era where those truck drivers have mobile phones and are asking Google for “the nearest motel”.

|

| The findings of our research hold true across all three market tiers. |

Final Thoughts -- For Now

Many of us have learned that “correlation is not causation”. In this case, however, we should assume a degree of causation because all findings are the results of Google’s explicitly engineered algorithms. In June, DMW predicted that the new Carousel SERP page would further drive a Google-centric POEM environment, and this research has empirically demonstrated just that: earned media (online guest reviews) is now a major component of Google's search results (via Carousel) for hotels.

We also predicted that rates, informed by Google HPA, would begin to show up in Carousel. As of Sunday, this is now an official feature in the Google Maps app for Android. We are sure that Carousel will be soon to follow. When it does, we will provide findings on the correlation between price and rank -- especially for the popular "cheap hotels in..." search query. We also predict, however, that any brand that views HPA as a siloed exercise in Paid media will see suboptimal results. Google HPA must be considered in the context of Review optimization --and of all POEM media-- as well.

|

| The new Google Maps app for Android highlights an optimized hotel search experience (with rates) and the benefits of "reviews from trusted friends and experts" |

We also predicted that rates, informed by Google HPA, would begin to show up in Carousel. As of Sunday, this is now an official feature in the Google Maps app for Android. We are sure that Carousel will be soon to follow. When it does, we will provide findings on the correlation between price and rank -- especially for the popular "cheap hotels in..." search query. We also predict, however, that any brand that views HPA as a siloed exercise in Paid media will see suboptimal results. Google HPA must be considered in the context of Review optimization --and of all POEM media-- as well.

When taken all together, our findings are a good-news story for hotels. Suppliers have a big opportunity to win share back from the OTAs by grabbing the brass ring on Google's Carousel -- no OTAs are allowed on this ride!

What's Next?

We believe this research to be an industry first, and we will re-run our research on a periodic basis to track changes that may result from future Google updates. We are happy to respond to questions. Please ask in Comments, below.

By Aaron Zwas -- Director of Emerging Technologies at Digital Marketing Works